Board Of Directiors

- Position:

- Home >

- ESG Sustainability >

- Corporate Governance >

- Board Of Directiors

< SpeedTech:Corporate Governance>

Directorship Experience

According to the Articles of Association of the company, the company has 7 to 9 directors, adopts a candidate nomination system, and the shareholders’ meeting selects director candidates from the list. The company currently has 8 members of the board of directors, including 3 independent directors, accounting for 37.5% of the total, and 2 directors with employee status, accounting for 25%. In addition, the composition of the board of directors also pays attention to gender equality. Including 1 female member, female directors accounted for 12.5%| Title | Name | The main meridian | Currently Serving as Company and Other Companies |

| Chairman of the Board of Directors | FORTUNE SHARE CORPORATION Representative: Tsai, Chen-Lung | Department of Information Systems, Western United States International University. Master of Electronic Computer Engineering, Arizona State University. | Stech International Co., Ltd. Chairman of the Board of Directors of Speedtech(LS-ICT)Co., Ltd., Legal representative of Dongguan Leader Precision Industry Co., Ltd., Director of Luxshare Precision Accessory (Kunshan) Ltd, Chairman of SPEED TECH INCT SDN.BHD., Director of Castle Rock, Inc. & President of Tai Bridge Investment Holding Co.,, President of Assem Technology Co., Ltd., President of Taihan Precision Technology Co., Ltd., Director of CalDigit Holding Limited (Cayman), Director of CalDigit Limited (Hong Kong) |

| Director | FORTUNE SHARE CORPORATION Representative: Hsu, Chia-Te | Graduate Diploma in Strategic Management, Harvard University, USA Master of International Trade Management, Boston University, USA. | General manager of Well-Spring Enterprise Corporation, Independent Director of KWONG LUNG ENTERPRISE CO., LTD., Legal Representative of Director of Heli Investment Co., Ltd., IR/Stock Office Director of Speed Tech Corp. |

| Director | ASUS INVESTMENT CO., LTD. Representative: Shih, Jung-Hui | Master of Accounting of Soochow University Senior Manager of Asustek Computer Inc. | Project Manager of Pegatron Cor. |

| Director | ICT- Lanto Limited Representative: Tsai, Chia-Wei | MIS Master of Concordia University Wisconsin, Sale Manager of International Super Micro Technology Co., Ltd |

Vice President of Marketing and Sale of Taiwan Luxshare-Ict Co., Ltd. Director of CalDigit Holding Limited Director of CalDigit Limited Director of CalDigit (Europe) Limited |

| Independent Director | Chan, Ho-Po | Master of Chinese Culture University in Department of Business Administration Assistant manager of Liteon Technology Corporation | Chairman of Kwong Lung Enterprise Co., Ltd. |

| Independent Director | Chung, Ding-Chun | Master of National Taiwan University in International Business Director and General Manager of AnChiao Assets Management Corporation | Director of Hec Corporation, Legal representative of Director of Royalty Founder Enterprise Co., Ltd., Supervisor of Optima Corporation, Director of Transwell Biotech Corporation |

| Independent Director | Lin, Jyun-Yi | Master of Fujen school of law. Completion of the 42nd phase of the Judicial Training Institute | Presiding attorney of Hengshenglaw firm. Representative of legal person director of HOLD JINN ELECTRONICS CO., LTD. Representative of legal person director of MAX ZIPPER CO., LTD. Representative of legal person director of KINMEN KAOLIANG LIQUOR INC. Representative of legal person director of TAIWAN SPORTS LOTTERY CO., LTD. |

| Independent Director | Liang, Hsiang-I | Master of the Institute of Information Technology, National Taiwan University

Master of EMBA, the College of Management, National Taiwan University

Vice General Manager of Hsun Ying Technology Co., Ltd.

Vice General Manager of Yam Digital Technology Co., Ltd. |

Director of Shumei Culture and Arts Foundation Independent Director and Host of AI Development Project of 104 Corporation Digital Development Consultant of CommonWealth Magazine |

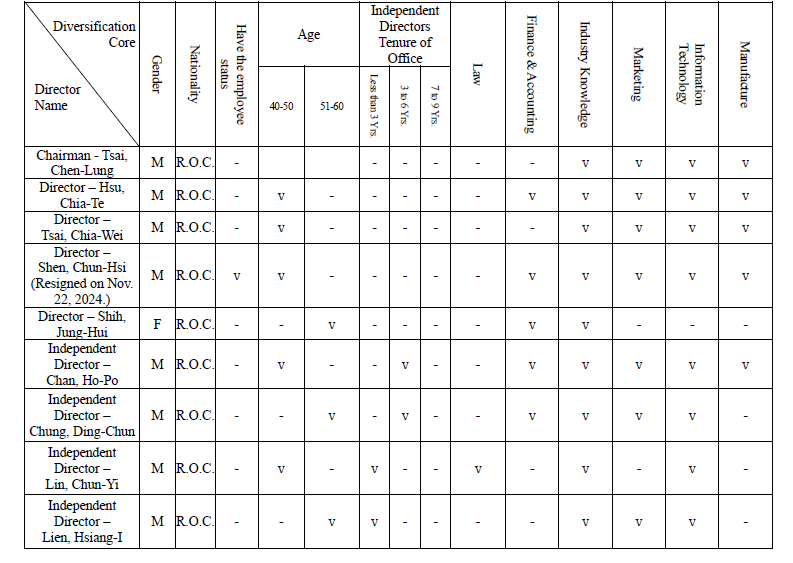

Diversification and Independence of the Board of Directors

In accordance with Article 20 of the company’s “Corporate Governance Best Practice Principles”, it is stipulated that the composition of the members of the Board of Directors should take diversification into consideration and map out the diversification policy in terms of the company’s operation, the operational pattern and the development needs, including the basic composition (e.g. gender, age, nationality and culture, etc.), the professional knowledge and skill: the professional background (e.g. law, accounting, industry, finance, marketing or technology), expertise and industrial experience, etc. The members of the Board of Directors should possess the knowledge, skill and competence, which is required for performing the job duties. In addition, in order to attain to the corporate governance goal, the abilities the Board of Directors should have as a whole include ::

1、Operation judgment ability.

2、Accounting & financial analysis ability.

3、Business management ability.

4、Crisis management ability.

5、Industry knowledge.

6、International market vision.

7、Leadership.

8、Decision-making ability.

At present, there are 8 current members in the Board of Directors, including 3 independent directors, representing 37.5%, as well as 2 directors who are the employees, accounting for 25%. Besides, the member composition of the Board of Directors also puts emphasis on the gender equality. Among the board members, there is one female director, representing 12.5%. In the future, the company will strive to increase the seat of the female director in order to achieve the goal by the ratio of the female directors reaching one third of the director seats. The independent directors of the company all comply with the regulations of the competent authority regarding the independent director and they do not involve any conditions specified in Paragraphs 3 & 4, Article 26-3 of the Securities and Exchange Act.

Diversification Policy and Implementation Status of the Current Members of the Company’s Board of Directors are as follows:

Important Resolutions of the Board of Directors

2025

| Date | Important resolution | Resolution and implementation |

The Implementation of the Corporate Governance

| Title | Name | Actual attended(B) | Entrusted Seats | The retio of actual attended seats(B/A) | Remark |

| The 14th Board of Directors convened 5 (A) meetings in 2024. The attendance of directors and independent directors was as follows: | |||||

| Chairman of the board of directors | Fortune Share Corporation Representative: Tsai, Chen-Lung | 4 | 1 | 80% | |

| Director | Fortune Share Corporation Representative: Hsu, Chia-Te | 5 | 0 | 100% | |

| Director | ICT- Lanto Limited Representative: Tsai, Chia-Wei | 5 | 0 | 100% | |

| Director | ICT- Lanto Limited Representative: Shen, Chun-Hsi (Resigned on Nov. 22, 2024.) | 3 | 1 | 75% | |

| Director | ASUS INVESTMENT CO., LTD. Representative: Shih, Jung-Hui | 4 | 1 | 80% | |

| Independent Director | Chan, Ho-Bo | 4 | 1 | 80% | |

| Independent Director | Chung, Ding-Chun | 5 | 0 | 100% | |

| Independent Director | Lin, Chun-Yi | 5 | 0 | 100% | |

| Independent Director | Lien, Hsiang-I | 4 | 1 | 80% | |

| The 14th Board of Directors convened 2 (A) meetings in 2025. The attendance of directors and independent directors was as follows: | |||||

| Chairman of the board of directors | Fortune Share Corporation Representative: Tsai, Chen-Lung | 2 | 0 | 100% | |

| Director | Fortune Share Corporation Representative: Hsu, Chia-Te | 2 | 0 | 100% | |

| Director | ICT- Lanto Limited Representative: Tsai, Chia-Wei | 2 | 0 | 100% | |

| Director | ASUS INVESTMENT CO., LTD. Representative: Shih, Jung-Hui | 1 | 1 | 50% | |

| Independent Director | Chan, Ho-Bo | 2 | 0 | 100% | |

| Independent Director | Chung, Ding-Chun | 2 | 0 | 100% | |

| Independent Director | Lin, Chun-Yi | 2 | 0 | 100% | |

| Independent Director | Lien, Hsiang-I | 2 | 0 | 100% | |

- The operation of the Board of Directors incurred the following circumstances:

1.1The matters listed in Article 14-3 of the Securities and Exchange Act:

Meeting Date

Session

Motion Content

The opinion of the independent director

How does the company deal with it

March 12, 2024

9th of Session 14

1. Proposal of bank finance credit.

2. Proposal of compensation distribution for employees and directors in 2023.

3. Proposal of the Company’s 2023 business report and financial statements.

4. Proposal of the Company’s 2023 earnings distribution.

5. Proposal of evaluating whether overdue accounts receivable and other accounts of the Company and the subsidiaries involve disguised fund loans.

6. Proposal of the Company’s investment in Leader’s joint venture company in Vietnam.

7. Proposal of report on the Company’s issuance of the domestic 2nd and 3rd unsecured corporate bonds.

8. Proposal of the Company’s Internal Control System Declaration in 2023.

9. Proposal of amendment of partial controlling operation process of the “Sales and Collection Cycle”, and the “Purchase and Payment Cycle” in the Company’s

internal control system.

No objection

None

May 10, 2024

10th of Session 14

1. Proposal of bank finance credit.

2. Proposal of amendment of the business report in 2023.

3. Proposal of evaluating whether overdue accounts receivable and other accounts of the Company and the subsidiaries involve disguised fund loans.

4. Proposal of new authorized capital of 100% shareholding subsidiary in Singapore.

5. Proposal of the Company’s new foreign exchange forward deal amount.

6. Proposal of the Company’s selling of equipment for mass production in the Mexico factory to Speed Tech’s 100% shareholding subsidiary in Singapore.

No objection

None

August 9, 2024

11th of Session 14

1. Proposal of bank finance credit.

2. Proposal of evaluating whether overdue accounts receivable and other accounts of the Company and the subsidiaries involve disguised fund loans.

3. Proposal of amendment of the Company’s “Internal Control System”, the “Internal Control Self-assessment”, and the “Implementation Rules for Internal Audits”.

4. Proposal of amendment of partial articles of “Property Management Procedures“ in the Company’s internal control system.

5. Issuance ofRestricted stock awards, insiders’ distribution roster and number of shares in 2024.

6. Proposal of review of the payroll system and remuneration of the Company’s directors and managers.

7. Proposal of purchase of equipment for SMT production line expansion in Mexico.

No objection

None

November 8, 2024

12th of Session 14

1. Proposal of execution of factory buildup and equipment purchase for the Company’s investment in Leader’s joint venture company in Vietnam.

2. Proposal of the Company’s exercise of conversion of the new issued shares of employee stock option certificate in 2018.

3. Adjustment of distribution roster for issuance of restricted stock awards in 2024.

4. Proposal of bank finance credit.

5. Proposal of establishment of the 2024 audit plan.

6. Proposal of amendment of partial articles of the controlling operation process of the “Production Cycle” in the Company’s internal control system.

7. Proposal of amendment of partial articles of the controlling operation process of the “Purchase and Payment Cycle” in the Company’s internal control system.

8. Proposal of evaluating whether overdue accounts receivable and other accounts of the Company and the subsidiaries involve disguised fund loans.

9. Proposal of appointment and compensation of the Company’s CPAs in 2025, and evaluation of CPAs’ independence and Competence.

No objection except withdrawal of Proposal 1.

None

November 22, 2024

13th of Session 14

1. Proposal of execution of factory buildup and equipment purchase for the Company’s investment in Leader’s joint venture company in Vietnam.

No objection

None

March 10, 2025

14th of Session 14

1. Proposal of compensation distribution for employees and directors in 2024.

2. Proposal of the Company’s 2024 business report and financial statements.

3. Proposal of the Company’s 2024 earnings distribution.

4. Proposal of year-end bonus distribution for insiders in 2024.

5. Proposal of discussion of salary raise for the Company’s managerial officers.

6. Proposal of report on the Company’s issuance of the domestic 3rd unsecured corporate bonds.

7. The Company’s processing of cancellation of shares of restricted stock awards and proposal to set the base date of capital decrease.

8. Proposal of amendment of partial articles of the Company’s “Articles of Incorporation”.

9. Proposal of reelection of all directors of the Company.

10. Proposal of lifting non-compete restriction for the Company’s new directors and their representatives.

11. Proposal of bank finance credit.

12. Proposal of evaluating whether overdue accounts receivable and other accounts of the Company and the subsidiaries involve disguised fund loans.

13. Proposal of the Company’s Internal Control System Declaration in 2024.

14. Proposal of date and matters convened for the 2025 annual shareholders’ meeting.

No objection

None

March 28, 2025

15th of Session 14

1. Proposal of equipment purchase of the Company’s factory in Mexico.

2. Proposal of reelection of all directors of the Company.

3. Proposal of slate of nominated directors (including independent directors) candidates for resolution.

4. Proposal of date and matters convened for the 2025 annual shareholders’ meeting.

No objection

None

1.2 Except for the preceding matters, other resolved matted of the board of directors that have been objected to or retained by independent directors and have a record or written statement: None.

2.The implementation of avoiding stake motion to the directors:

3.Execution Status of the Board of Directors’ Assessment:Date of Board Meeting

Name of Directors for Avoiding Stake

Motion Content

Reason for Avoiding Stake and Participation in Voting

March 12, 2024

Shen, Chun-Hsi

(Resigned on Nov. 22, 2024.)

Proposal of the year-end bonus distribution for the Company’s managers in 2023.

As the payee of the proposed fee in this proposal, which involved his own stake, he shall not participate in discussion and voting in accordance with Article 206, the Company Act; other attending directors unanimously approved this case without objections.

August 9, 2024

Shen, Chun-Hsi

(Resigned on Nov. 22, 2024.)

Hsu, Chia-Te

Proposal of review of the payroll system and remuneration of the Company’s directors and managers.

As the payee of the proposed fee in this proposal, which involved his own stake, he shall not participate in discussion and voting in accordance with Article 206, the Company Act; other attending directors unanimously approved this case without objections.

March 10, 2025

Tsai, Chen-Lung

Hsu, Chia-Te

Lin, Hung-Sheng

Proposal of year-end bonus distribution for insiders in 2024.

Because President Tsai, Chen-Lung, Director Hsu, Chia-Te, and Financial & Accounting Manager Lin, Hung-Sheng made recusal due to involving their own stake in this proposal, after making inquiry with all other attending directors by Deputy Chairperson, i.e. Independent Director Chan, Ho-Po, no objection was made, and the proposal was approved unanimously.

March 28, 2025

Tsai, Chen-Lung

Hsu, Chia-Te

Tsai, Chia-Wei

Shih, Jung-Hui

Chan, Ho-Bo

Chung, Ding-Chun

Lin, Chun-Yi

Lien, Hsiang-I

Proposal of slate of nominated directors (including independent directors) candidates for resolution.

Each stakeholder made recusal at the time of his/her qualification assessment, and the proposal was approved unanimously by all other attending directors.

Evaluation Cycle | Period | Range | Procedure | Content |

Once a Year | January 1, 2024 – December 31, 2024 | Board of Directors | Internal Self-assessment | The items for consideration in the Board of Directors’ performance assessment included the following five aspects: 1. Participation in the company’s operation. 2. Enhance the Board of Directors’ decision-making quality. 3.Composition and structure of the Board of Directors. 4. Election and continuous training of the directors. 5. Internal control. |

Audit Committee | Internal Self-assessment | The items for consideration in the Audit Committee’s performance assessment included the following five aspects: 1. Participation in the company’s operation. 2. Awareness of duties and responsibilities of the Audit Committee. 3. Enhance the Audit Committee’s decision-making quality. 4. The Audit Committee’s composition and election of its members. 5. Internal control. | ||

Remuneration Committee | Internal Self-assessment | The items for consideration in the Remuneration Committee’s performance assessment included the following five aspects: 1. Participation in the company’s operation. 2. Awareness of duties and responsibilities of the Remuneration Committee. 3. Enhance the Remuneration Committee’s decision-making quality. 4. The Remuneration Committee’s composition and election of its members. 5. Internal control. | ||

Individual Board Director | Director’s self-assessment | The items for consideration in the individual director’s performance assessment of the Board of Directors included the following six aspects: 1. The control of the goal and tasks of the Company. 2. Awareness of duties and responsibilities of the directors. 3. Participation in the company’s operation. 4. Internal relationship management and communication. 5. Professionalism and continuous training of the directors. 6. Internal control. |

The Company has completed the Board of Directors self performance assessment in 2024, and the assessment results was submitted for reporting to the meeting of the Board of Directors on March 10, 2025 as a basis of review and improvement. The overall average score of the Board of Directors self performance assessment was 98.56 score (100 scores in full), the overall average score of the Audit Committee self performance assessment was 99.75 score (100 scores in full), the overall average score of the Remuneration Committee self performance assessment was 100 score (100 scores in full), and the overall average score of the individual director’s self performance assessment was 98.3 score (5 scores in full). It was suggested that the implementation of the entire Board of Directors was good.

4.Evaluation of the goal and execution status of the reinforcement of the Board of Directors’ function in the current year and the most recent year:

(1) Because the Company’s president also served as the vice president, one new independent director was elected at the first special shareholders’ meeting in accordance with the regulations and the competent authority’s requirements on December 22, 2023.

(2) The Company set up the Remuneration Committee according to the law to take charge of enacting and regularly reviewing the performance evaluation of directors and managers, the policy, system, standards and structure of the salary & remuneration, and establishing the salary & remuneration of directors and managers.

(3) This Company has stipulated the rules of the performance evaluation for the Board of Directors, and carried out the internal performance assessment of the Board of Directors, its individual members, the Audit Committee, and the Remuneration Committee in accordance with the preceding rules; besides, we authorized the Taiwan Investor Relations Institute to conduct the external assessment of the Board of Directors performance once three years.

The Training Status of the Company’s Directors and Supervisors is as Follows:

In order to implement the corporate governance system, the Company has been taking the initiative in informing the directors and supervisors of training opportunities regarding corporate governance information. The status of participation in the external training courses is as follows:

Title | Name | Training Date | Organizer | Course Title | Training Hours |

Representative of Directors’ Legal Person | Tsai, Chen-Lung | 2024/07/03 | Taiwan Stock Exchange | Cathay Sustainable Finance and Climate Change Summit | 6 Hours |

Representative of Directors’ Legal Person | Hsu, Chia-Te | 2024/07/03 | Taiwan Stock Exchange | Cathay Sustainable Finance and Climate Change Summit | 6 Hours |

Representative of Directors’ Legal Person | Tsai, Chia-Wei | 2024/11/08 | Taipei Foundation of Finance | Corporate Governance – Talk about Control of Shareholder’s Role and Accountability from the View of Corporate Governance | 3 Hours |

2024/12/09 | Taipei Foundation of Finance | Corporate Governance – Information Security – Personal Information Security Audit | 3 Hours | ||

Representative of Directors’ Legal Person | Shen, Chun-Hsi (Resigned on Nov. 22, 2024.) | 2024/03/12 | Taiwan Corporate Governance Association | International Trend of Ethical Corporate Management and High-level Accountability, along with Experience Share | 3 Hours |

2024/11/08 | Taipei Foundation of Finance | Corporate Governance – Talk about Control of Shareholder’s Role and Accountability from the View of Corporate Governance | 3 Hours | ||

Representative of Directors’ Legal Person | Shih, Jung-Hui | 2024/11/08 | Taiwan Corporate Governance Association | Interpretation on Investment Planning of Business Merger Equity and Practice of Joint Venture Agreement | 3 Hours |

2024/12/05 | Taiwan Corporate Governance Association | Impact of Climate Change on Financial Statements | 3 Hours | ||

Independent Director | Chan, Ho-Po | 2024/05/09 | Taiwan Corporate Governance Association | Corporate Governance and Director’s Responsibility | 3 Hours |

2024/11/07 | Taiwan Corporate Governance Association | Hit of Carbon Wave and Overview on Formation & Trading System of Carbon Credit | 3 Hours | ||

Independent Director | Chung, Ding-Chun | 2024/05/03 | Securities & Futures Institute | Publicity Seminar on Sustainable Development | 3 Hours |

2024/11/22 | Securities & Futures Institute | Publicity Seminar on Insider Equity Trading Law Compliance in 2024 | 3 Hours | ||

Independent Director | Lin, Chun-Yi | 2024/05/13 | Taiwan Corporate Governance Association | Insider Trading and Ethical Management – Responsibility of Directors and Supervisors on Illegal Securities Cases | 3 Hours |

2024/11/08 | Taiwan Corporate Governance Association | Knowledge and Prevention of Unlawful Infringement in Workplace (Including Updated Amended Regulations of Act of Gender Equality in Employment) | 3 Hours | ||

Independent Director | Lien, Hsiang-I | 2024/06/13 | Securities & Futures Institute | Research and Analysis of Theory and Practice of Trade Secret | 3 Hours |

2024/06/13 | Securities & Futures Institute | Carbon Credit Trading Mechanism and Carbon Management & Application | 3 Hours |

2024 Director Membership and Board Performance Evaluation Report

I. Internal EvaluationIn accordance with the Company’s “Board of Directors Performance Evaluation Method”, the performance evaluation was conducted via questionnaire. The evaluation was completed on February 14, 2025, and the results were submitted to the Board of Directors on March 10, 2025.

1. Evaluation Period:From January 1, 2024, to December 31, 2024.

2. Evaluation Procedure:The IR/Shareholder Affairs Office distributed self-assessment questionnaires to all members of the relevant committees. After compilation, the evaluation results were submitted in a report to the Board of Directors.

3. Evaluation Indicators:

-

(1) The board performance evaluation includes five main aspects, namely participation in company operations, improvement of board decision-making quality, board composition and structure, director nomination and ongoing professional development, and internal controls, covering a total of 40 indicators.

(2) The performance evaluation of individual board members includes six main aspects, namely understanding of the company’s goals and tasks, awareness of director responsibilities, participation in company operations, management of internal relationships and communication, professional expertise and ongoing development, and internal controls, covering a total of 25 indicators.

(3) The performance evaluation of the Audit Committee includes five main aspects, which cover participation in company operations, awareness of the Audit Committee’s responsibilities, improvement of the Audit Committee’s decision-making quality, composition and member nomination of the Audit Committee, and internal controls, covering a total of 20 indicators.

(4) The performance evaluation of the Remuneration Committee includes five main aspects, which cover participation in company operations, awareness of the Remuneration Committee’s responsibilities, improvement of the Remuneration Committee’s decision-making quality, composition and member nomination of the Remuneration Committee, and internal controls, covering a total of 20 indicators.

(1) According to the board performance evaluation guidelines, the total score for each performance evaluation is 100 points, with a score of 80 or above considered “Excellent,” 60 to 79 considered “Satisfactory,” and 59 or below considered “Needs Improvement.”

(2)The board performance evaluation was rated as Excellent.

(3)The performance evaluation of individual board members was rated as Excellent.

(4)The Audit Committee performance evaluation was rated as Excellent.

(5)The Remuneration Committee performance evaluation was rated as Excellent.

- Note:

- ⋆⋆⋆⋆⋆ Excellent: the average score exceeds 4.5 points.

- ⋆⋆⋆⋆ Excellent: The average score is 3.5~4.4.

- ⋆⋆⋆ Medium: Average score is 2.5~3.4.

- ⋆⋆ Poor: Those with an average score of 1.5~2.4.

- ⋆ Extreme Poor: Those with an average score below 1.4.